Before we start, do you know how few people take health insurance and people still think that they will take a policy only when they get sick. Are you also one of those people? Tell us in the comment section below. Today’s Video Top 10 Helplines from Star Health Insurance Care Health Insurance Nava Bupa Health Insurance and Aditya Birla Health Insurance in which we will look at 5 Black Family Floater Plans

5 Black Family Floater Insurance Plan

First of all, let us look at the eligibility, in all four plants, the age limit for dependent children is 91 days and 25 years, and the adult age is 18 years and 65 years in Star Health Care Health and Nava Health , whereas in Aditya Birla, there is 18 years to no upper limit, that is, you can apply for this You can purchase the plan anytime but keep this thing in mind that the older the elderly members are in the plan, the higher will be your premium, hence the younger you take a health plan, the lower will be your premium. comes in use

The maximum number of family members in Star Health is five, which includes two adults plus three dependent children, Care Health and the maximum number of six members in Nava Health , which includes self, spouse, two children and two parents, and 5 in Aditya Birla Health. members include those who are

premium

Self Spouse and Three Dependent Children After this comes the premium health plan. While taking a premium health plan, it is not necessary that a plan with low premium is good because due to low premium, the features and value added services of the plan also become useful, hence while taking the plan, only look at the premium. This is not enough. The monthly premium of Star Health Insurance is Rs 2497. While calculating the premium, we have included tax members here so that everyone’s premium can be calculated accordingly. The monthly premium of Can Help Line is Rs 2498.

Niva Health Care’s tier is 2086 and Aditya Birlakand’s is 1948. Talking about network hospitals, Star Health ‘s tier is 11000 plus with hospital, Care Health Insurance’s 9500+, Niva Health ‘s 9000 plus and Aditya Birla Health 8500a plus with hospital. While taking the policy, it is very important to check whether the hospital near your house is in the network hospital of the company or not.

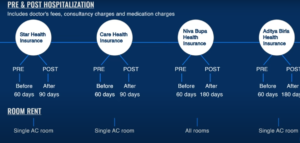

Otherwise, even if the policy is good, if you cannot go to the network hospital of the policy, then there is no use in taking the policy. Doctor’s fees, consultancy charges and medication charges are all included in pre and post hospitalization expenses. Free hospitalization in all four plans. It is 60 days and in post hospitalization, 90 days of Star Health Insurance and Care Health Insurance and the same 180 days of Niva Health Insurance and Aditya Birla Health Insurance now comes.

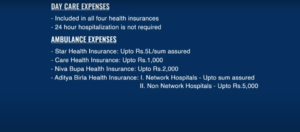

Room Rent: On Star Health Insurance Care Health Insurance and Aditya Birla Health Insurance, a single room is included and in Niva Health Insurance, you can choose any room as per your choice. Day care expenses are included in all the four plants. By giving the expense, I will give you 24 hours. There is no need for hospitalization and all the expenses related to it are included. If we talk about ambulance expenses, then in Star Health Insurance you are covered for all shots i.e. your ambulance expenses are covered up to Rs 5 lakh, whereas in Care Health Insurance there is a limit of Rs 1000. And Niva Health Insurance has a limit of up to ₹ 2000. On Aditya Birla Health Insurance, if you go to a network hospital, you are covered up to a sum of Rs.

And in non-network hospitals, you will get a cover of Rs 5000. Domicile benefit is available in all four plants. Normal salary expense means that now you get your treatment done at home, but when can this happen when there are less beds in the hospital or you have to go to the hospital. Both expenses are covered up to Rs 5 lakh on Star Health Niva Health and Aditya Birla Health Insurance, but the limit on Care Health Insurance is Rs 50,000. You can take preventive health checkups once in a year under Star Health Insurance.

Up to Rs 2000 Care Health Insurance and once a year in Birla Health Insurance for all members and from Niva Health Insurance you can claim ₹ 500 for every Rs 1 lakh, so according to this plan you can claim preventive health up to ₹ 2500. You can get a checkup done for restoration benefits.

Restoration benefit

Restoration benefit means that if your base premium expires in a year, then the premium will be refilled for the same amount of year in one shot. Both related and unrelated illnesses are covered on Star Health Care Health and Niva Health . You can take claim only on unrelated illnesses but Aditya Birla Health can take claim only on unrelated illnesses so you can get very good benefits due to restoration.

If we talk about claim bonus, then no claim bonus means that if you have not made any claim in the plan in a year, then the company will increase your sum insured in Star Health , Niva Health and Aditya Birla Health . If you do not take a claim, you get an additional tax of Rs. 2.5 lakh every year, where the maximum tax can be up to Rs. 10 lakh. In Care Health if you do not take a claim, you get an additional tax of Rs. 1.25 lakh, where the maximum tax can be up to Rs. 10 lakh. There is a waiting period of 30 days after purchasing the policy in all four plans.

Accept for Accidents Specific Illnesses

Talking about Accept for Accidents Specific Illnesses, there is a waiting period of 2 years in all four plans.

Specific illnesses include illnesses like cataract, obesity etc. And if you have any pre-existing disease before taking the policy, you can claim the related expenses only after the waiting period. Star Health Niva Health and Aditya Birla Health Insurance has a waiting period of 3 years and Care Health has a waiting period of 4 years

This was about the best health care plans. You can choose any plan as per your convenience. You can tell us in the comment section which health plan you like best for you.