Top Health Insurance Plans in India: Detailed Analysis and Comparison

In today’s blog, we will be analyzing in detail three of the best health insurance plans in India—HDFC ERGO’s Optima Super Secure, Niva Bupa’s ReAssure 2.0, and Star Family Health Optima. The purpose of this post is to help you choose the right insurance plan, so that you and your family are protected.

Claim Insurance Settlement Ratio

HDFC ERGO Optima Super Secure insurance: 99.8% (FY 2020)

Niva Bupa ReAssure 2.0 insurance: 91.20%

– Star Family Health Optima insurance : 85.47%

In terms of claim settlements, HDFC ERGO is at the forefront, especially during the pandemic. HDFC ERGO has also had the best performance in the last financial years (2021-2022).

2. Premium

HDFC ERGO insurance plan is the most expensive, followed by Niva Bupa.

– Star’s plan is the cheapest, which attracts many people.

One thing to note is that one should not choose a plan just because of its cheap premium; It is important to check whether the plan completely covers your needs.

3. Pre-Hospitalization और Post-Hospitalization Expenses

– All three plans offer 60 days of pre-hospitalization and 180 days (HDFC ERGO and Niva Bupa) or 90 days (Star) post-hospitalization cover.

4. Ayurvedic Treatment

– Ayurvedic treatment is covered in both HDFC ERGO and Niva Bupa.

– Star has a limit of Rs 20,000.

5. Preventive Health Checkup

– HDFC ERGO: Reimbursement of Rs 500 per lakh on cover of Rs 5 lakh.

– Niva Bupa: Checkup will have to be done at affiliated centers, reimbursement is not available.

– Star: Reimbursement option available.

6. Co-payment

– There is no co-payment option in HDFC ERGO and Niva Bupa.

In Star, 20% co-payment is mandatory for those above 60 years of age.

7. Waiting Period

– All three policies have the same waiting period:

– Initial: 30 days

– Specific Illnesses: 2 साल

– Pre-existing Diseases: 3 साल

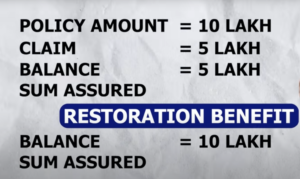

8. Restoration Benefit

– HDFC ERGO: Unlimited restoration benefits, applicable even for a single disease.

– Niva Bupa: Unlimited restoration available by default.

– Star: Restoration is available once a year.

9. BONUS

HDFC ERGO’s bonus system is a bit complex, whereas Star’s is the simplest and best.

HDFC ERGO offers a bonus of 25% in the first year and 10% every year thereafter, but it reduces by 10% on taking claims.

- Seeker Benefit

– Seeker benefit is available in HDFC ERGO, which increases your base coverage.

– Niva Bupa and Star do not have this facility.

- Organ Donor

– Organ donor cover is available in both HDFC ERGO and Niva Bupa.

– This feature is not available in Star.

- Hospital Network

– HDFC ERGO: 13,000+ hospitals

– Niva Bupa: 5,000+ hospitals

– Star: 11,000+ hospitals

13. Robotic Surgery and Modern Treatment

– The entire sum insured is covered in HDFC ERGO.

– Niva Bupa and Star have capping.

14. Additional Expenditure

HDFC ERGO covers all additional expenses.

– Niva Bupa and Star have an exclusion list of 60+ items.

Conclusion: Which plan is best?

Keeping all the important points in mind, my personal ranking is as follows:

- HDFC ERGO Optima Super Secure

- Niva Bupa ReAssure 2.0

- Star Family Health Optima

HDFC ERGO plan is the best as it offers unlimited restoration, seeker benefit, and additional expenditure coverage. Niva Bupa’s plan is also good, especially for those who want stable premiums. Star’s plan is the best for the budget, but it has some limitations.

Note: Always choose the plan according to the needs of your family. If you don’t have health insurance yet, consider getting a plan immediately.