Which mutual fund scheme is right

Best SIP plan If I ask you what is the most important thing in life, then most of you will have only two answers: Health and Wealth. In today’s time, you may not be able to become wealthy through health, but you can afford your health without wealth. In simple words, in today’s time, the hospital bill is costing more than food, clothes and house. This problem may seem small to us during youth, but when you reach your retirement age, You regret your mistakes that if you had made some savings, today you would have been able to pay for a hospital but now instead of being afraid of any financial situation, you need to take a small step of monthly investment, in this we will tell you. How is this for long term shipping?

you are looking at S Fund S Fund where your investment is right and easy S Fund where now you can take out a loan against a mutual fund. Yes, from anywhere, anytime. Where can you take a loan against your mutual fund investment on Set Funds App? So download it today and know about the features of Loan Against Mutual Fund. Where is the Jeet Fund?

You can create a corpus worth crores by doing SIP of just Rs 1000.

Sure investment is right and easy. No matter what business you do or how much work you earn, you can still save 1000 in a month if you invest this 1000 systematically. start a SIP. Let us know how you can create a big corpus in the long term. Suppose you are around 20 years of age and today you start investing Rs 1000 monthly in a mutual fund scheme.

Make sure that you get 12% in the scheme. If you get a return of Rs. 120000 and you look at your portfolio after 10 years, then according to this calculation you can see that the amount you have invested in these 10 years has become Rs. 120000. 23239 Whereas if you keep the return and SIP amount the same, if you increase the time period from 10 to 20 years, then the total value of your investment becomes Rs 9 lakh 99148. Yes, the value of your invested Rs 240000 becomes approximately Rs 10 lakh.

If we increase this time to 20 to 40 years, then the value of your invested amount: Yes, Rs 4 lakh 80 thousand will become Rs 1 crore 18 lakh 82 thousand 420. Yes, the value of Rs 480000 will become approximately Rs 1 crore 18 lakh, now it is not even like that. Is

That you will invest only 1000 monthly for 40 years. As your income increases, you can also increase this SIP amount.

The feature of increasing the SIP amount is called Step Up Ship. If you increase the SIP amount at the rate of 10% annually, then after 40 years the total value of your investment amount will be Rs 3.5 crore. This is just a matter of figures. Now let’s talk about the best mutual funds for long term shipping. SIP In this list, we have included two mutual fund schemes each of mid and small cap category.

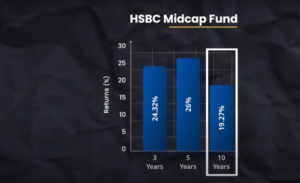

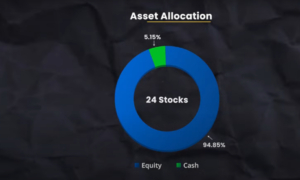

In this list, the first fund of Midcap Krantikari is HSBC MIDCAP Fund. This fund has done the last three Has given an annual return of 24.32% in the last 5 years and has given an annual return of 26% in the last 5 years and has given an annual return of 19.27% in the last 10 years. The benchmark of this fund is Nifty Midcap 150 Total Return Index. HSBC Mid Cap Fund has given a long term 11400 crore of this fund, 98% allocation of AUM of this fund is in equity stocks and there are 86 stocks in this fund SIP. If we talk about its equity sector allocation, then 9.4% of this fund is in large cap and 43.42% is in large cap. % is in mid cap and its exposure in small cap is 26.49% and the exposure of this fund SIP in the stocks of other categories is 18.82%.

The top five holdings of this fund are Suzlon Energy Limited, Comments India Limited SIP, Power Finance Corporation Limited, Bhi Limited and Godrej Properties. If you want, you can start investing in this fund for the long term.

Best SIP plan Returns are higher than the category average returns

This fund is most suitable for investors whose investment horizon is at least 5 years. Our next fund from Mid Cap Revolutionary is Motilal Oswal Mid Cap Fund. It has given an Annual Return of 38.45% in the last 3 years 34.37% in 5 years My Location 97.62% While the fund managers are keeping 2.38% in cash. There are currently 72 stocks in this fund.

The top five holdings of this fund SIP are K Industries Limited, Uno Minda Limited, JB Chemicals and Pharmaceuticals Limited, Kirloskar Pneumatic Company and Brigade Enterprises Limited. If you want to go for the long term. HSBC Small Cap Fund is the second fund of our small cap revolutionary. This fund has given an annual return of 29.24% in the last three years, an annual return of 32.02% in the last 10 years and 21.14% in the last 10 years.

The benchmark of this fund is Nifty Small Cap 250 Total Return Index. SIP HSBC Small Cap Fund has also given more returns in the long term than the average return of its category. The common fund of this fund is Rs 16400 crore. How is this fund allocated in equity? 97.54% and fund managers keep about two and a half percent in cash. This mutual fund scheme is a portfolio of 100 stocks. Top five holdings

Apar Industries Limited Enterprises Limited K Industries Limited Techno Electrical & Engineering Company Limited and East India Hotels Limited If you want, you can start your ship in this fund for long term Ship Where Jeet Funds Pay Download This Fund Let’s talk about your jet fund Know from the expert which mutual fund scheme is right for your long term portfolio. Download today for all the information. Talk to your Jet Fund expert wherever you are.