What are infrastructure themed mutual funds?

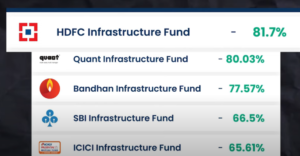

Infrastructure funds have given tremendous returns in the last one year. After several years of poor performance, the funds of this category have not only woken up, they have left many mutual fund categories behind in the race for returns in the last one year. Infrastructure themed mutual funds Will similar returns be made in these schemes in the future also? In this we will answer these questions of yours.

Your investment will be right and easy where you can do daily shipping. Yes, you can make similar money of 100 per day in your mutual fund journey. Apart from this, now you can see your entire mutual fund portfolio through the external portfolio feature of these funds.

Not only this, you can take a loan against this consolidated mutual fund portfolio. Yes, a loan against a mutual fund is now available in your consolidated portfolio. The loan will be disbursed in 4 hours through a digital process, so talk to your Jet Fund expert today. You might have heard about Vande Bharata Express, or perhaps you might have even traveled in this train by now.

You might have even driven on the new highway built outside your city. You might have heard that in the last 10 years, the number of airports in India has doubled. Yes, in 2014, there were 74 airports in India and in 2024, there were 74 airports in India. There are 148 airports. You are probably watching this on your mobile phone after recharging your data pack. Trains, roads, airports and mobile data and the fuel of trains, diesel and electricity which is energizing all these things, all these are parts of basic infrastructure. This infrastructure is the hope of our country’s economy and is creating and empowering this new growth.

India’s biggest companies like Reliance Industries, Adani Power, LNT Bharat Electronics and Shree Cement all have one thing in common. Long term projects are made. Let me explain with an example. In India, if you want to make a product in competition with Maggi or Lifebuoy soap or Wells Navy cigarettes.

The infrastructure company requires a lot of capital in the beginning.

If you want to start a business then it will not take you much time to manufacture them. You can build a noodles, soap and cigarette factory in 12 to 18 months and start selling your products or you can start selling your products for Nestle, Hindustan Unilever and ITC companies.

By giving manufacturing contracts to them, the products can reach their customers quickly, but the infrastructure making company cannot deliver its products to its customers in such a short period. You can see for yourself that a new power plant, a new airport, and a new highway are being built. It takes years but once these power plants, telecom infrastructure and cement plants are ready, they give continuous revenue and profit for many years. Due to this business reality.

The best way to invest is in infrastructure themed mutual fund schemes.

And if they are not able to execute their projects, then the investors of these companies can also suffer huge losses, that is, investing in infrastructure is a high risk high return strategy, so how to invest in these companies. Who is the fund manager of the company in this economy? We analyze which sector is experiencing the highest growth because these companies are always in need of capital, hence fund managers constantly review the interest rates and cost of capital in the economy.

Experience of fund managers in mutual funds Only after studying the company thoroughly, we add it to the portfolio and see whether the projects of these companies are feasible, whether this company will be able to complete its projects and whether this company can invest in these funds only after seeing the performance of the money raised from this market. Bharatiya Janata Party has released its manifesto for 2024 elections.

If the Modi government comes back then the Modi government will have special focus on two areas – low cost housing and innovation. BJP’s manifesto also says that Olympics will be organized in India in 2036 if projects like low cost housing and Olympics are executed in this country.

If there is, then there will be very rapid sales growth and profitability growth in the companies related to steel, cement and infrastructure, due to which the stocks of these companies will rise rapidly and infrastructure can be a theme which can give an excellent return to its investors in the coming time. it can be said

That infrastructure funds will give excellent returns in the times to come but do not keep the horizon of investing in infrastructure funds for 1 2 3 years.

The story of infrastructure funds in India is a long story which will give good returns to investors for many years. We always say that in the past Do not invest after seeing the returns of one year and if you are investing only for the next one year then do not invest in equity mutual funds. Which infrastructure funds are right for you?

Should you make a lump sum investment in these funds or should you do so? Talk to your statement expert today to know what you need Download Jet Funds Up Sa Fund Where is your investment Right and easy mutual fund investment and subject to market risk Read all scheme related documents Careful PSU Equity Mutual Funds These days your returns should also be can